The Definitive Guide to Offshore Company Formation

Table of Contents9 Simple Techniques For Offshore Company FormationHow Offshore Company Formation can Save You Time, Stress, and Money.How Offshore Company Formation can Save You Time, Stress, and Money.What Does Offshore Company Formation Mean?

Offered all these advantages, an offshore firm development in Dubai is the most appropriate type of enterprise if you are seeking to realise objectives and/or tasks such as any one of the following: Supply expert solutions, consultancy, and/or work as an agency Source foreign skill/ expatriate team Function as a Property Owning & Financial investment Company International profession Captive insurance coverage Tax exemption Nevertheless, overseas firms in UAE are not permitted to participate in the complying with organization activities: Finance Insurance as well as Re-insurance Aeronautics Media Branch set up Any kind of organization task with onshore firms based in UAE Business Advantages Of A Dubai Offshore Firm Development Absolute privacy as well as privacy; no disclosure of shareholders as well as accounts called for 100 per cent full possession by an international national; no regional enroller or companion required 100 percent exemption from company tax obligation for 50 years; this choice is eco-friendly 100 per cent exemption from personal revenue tax 100 per cent exception from import and also re-export duties Protection as well as administration of possessions Organization operations can be executed on a global level No restrictions on foreign ability or staff members No limitations on money as well as no exchange plans Workplace is not called for Capacity to open as well as maintain checking account in the UAE as well as abroad Capacity to billing regional as well as global clients from UAE Consolidation can be finished in much less than a week Capitalists are not needed to appear prior to authority to facilitate incorporation Vertex Global Professional provides specialised offshore business setup options to assist international business owners, financiers, as well as corporations establish a neighborhood existence in the UAE.Nonetheless, the share resources needs to be separated right into shares of equivalent nominal worth irrespective of the amount. What are the offered jurisdictions for an overseas company in Dubai and the UAE? In Dubai, presently, there is just one offshore jurisdiction offered JAFZA offshore. offshore company formation. In addition to JAFZA, the various other offshore jurisdiction within the UAE includes RAK ICC & Ajman.

In addition, physical presence within the country can also aid us get all the documentation done without any type of headaches. What is the duration required to begin an offshore firm in the UAE? In an excellent scenario, setting up an overseas company can take anywhere in between 5 to 7 working days. It is to be kept in mind that the enrollment for the very same can just be done via a signed up agent.

Some Of Offshore Company Formation

The overseas firm enrollment process should be carried out in complete guidance of a business like us. The demand of going for overseas business registration process is needed before establishing up a company. As it is needed to try this website meet all the problems after that one should refer to a proper organization.

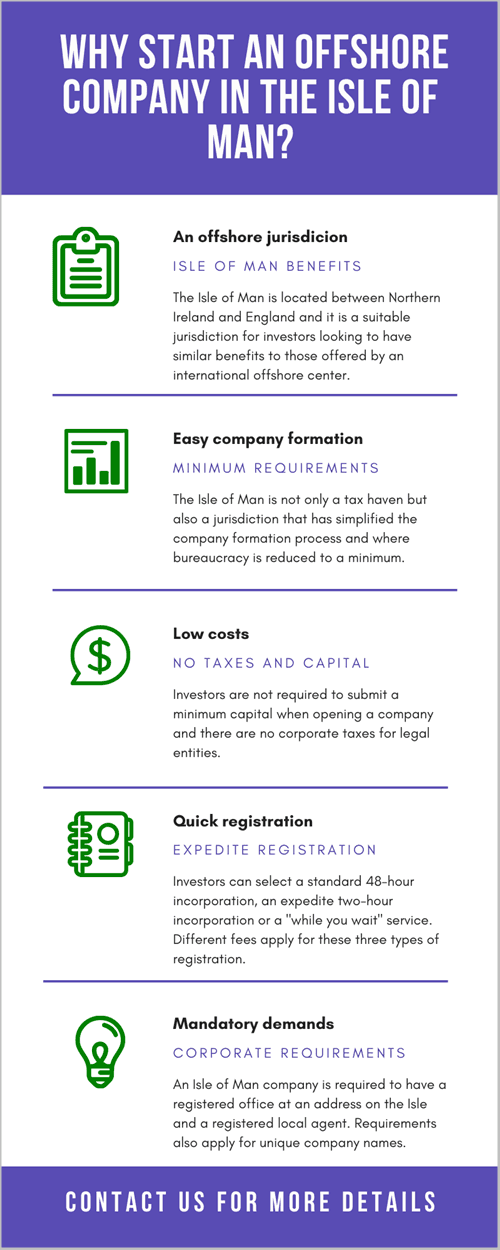

An is specified as a business that is incorporated in a jurisdiction that is apart from where the useful proprietor lives. In various other words, an offshore business is merely a company that is integrated in a country overseas, in an international jurisdiction. An offshore firm interpretation, however, is not that easy and also will have differing meanings depending upon the situations.

Offshore Company Formation Fundamentals Explained

While an "onshore firm" refers to a domestic company that exists as well as functions within the boundaries of a country, an offshore company in comparison is an entity that conducts all of its deals outside the boundaries where it is included. Due to the fact that it is possessed as well as exists as a non-resident entity, it is not liable to regional tax, as every one of its monetary transactions are made outside the borders of the territory where it is situated.

Firms that are formed in such overseas territories are non-resident due to the fact that they do not perform any kind of monetary purchases within their borders and are owned by a non-resident. Creating an overseas business outside the nation of one's very own home includes added defense that is located only when a business is incorporated in a different lawful system.

Because offshore firms are identified as a separate legal entity it operates as a separate individual, distinct from its proprietors you can try here or supervisors. This separation of powers makes a difference in between the owners as well as the firm. Any actions, financial debts, or obligations handled by the business are not passed to its supervisors or members.

Not known Facts About Offshore Company Formation

While there is no single criterion by which to measure an offshore business in all overseas territories, there are a number of features and distinctions unique to certain monetary centres that are thought about to be overseas centres. As we have said since an offshore firm is a non-resident and also conducts its purchases abroad it is not bound by local corporate taxes in the nation that it is included.

Standard onshore countries such as her explanation the UK and US, normally viewed as onshore financial facilities in fact have overseas or non-resident corporate policies that allow foreign business to include. These corporate frameworks additionally are able to be complimentary from neighborhood taxes although ther are developed in a typical high tax obligation onshore atmosphere. offshore company formation.

For more details on finding the ideal nation to develop your offshore firm go here. People and also business pick to develop an offshore company mostly for numerous reasons. While there are differences in between each offshore jurisdictions, they often tend to have the following resemblances: One of the most compelling factors to utilize an overseas entity is that when you make use of an offshore company framework it separates you from your business as well as assets as well as obligations.